-

Posted By Gautam Banthia

-

-

Comments 0

Table of Contents

ToggleIntroduction of Senior Citizens exemption limit:

In this article, we will discuss the exemption limit for senior citizens for filing an income tax return(ITR) in 2023. Understanding the tax benefits and exemptions available to senior citizens is essential for effective tax planning for filing ITR. We will see the eligibility criteria, different tax slabs, and deductions applicable to senior citizens. Income up to Rs 3 lakh to Rs 5 lakh 5% for FY 2023–24. However, with the new tax rebate, income up to Rs 7 lakh is tax-free under the new regime.

Eligibility Criteria for Senior Citizens:

To be considered a senior citizen for income tax purposes, an individual must meet the following age criteria:

- For the financial year 2022–23, a person aged 60 years or older but less than 80 years is classified as a senior citizen.

- An individual who is 80 years of age or older is categorized as a super senior citizen.

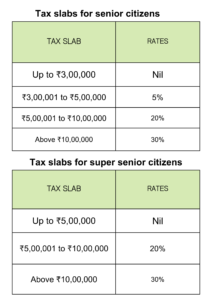

Tax Slab for Senior Citizens (Aged 60 and above but less than 80) and for Super Senior Citizens (Aged 80 and above): 2023

Returns and forms applicable for Senior Citizens:

Deductions available for Senior Citizens for Filing Income Tax Returns:2023

Apart from the exemption limits, senior citizens can also avail themselves of various deductions to reduce their taxable income. Some of the commonly applicable deductions include:

- Section 80C: Under this section, senior citizens can claim deductions up to 1.5 lacks on investments made in specified instruments like the Employee Provident Fund (EPF), the Public Provident Fund (PPF), the National Savings Certificate (NSC), etc.

- Section 80D: Senior citizens can avail themselves of deductions on health insurance premiums paid for themselves and their dependent family members. The maximum deduction limit is 50,000, which can go up to 1 lakh for super senior citizens.

- Section 80TTB: This section allows senior citizens to claim a deduction of up to 50,000 on interest earned from deposits in banks, cooperative societies, or post office schemes.

- Section 24(b): Senior citizens who have taken a home loan can claim deductions on the interest component of the loan repayment. The maximum deduction limit is Rs. 2 lakh.

Importance of filing the income tax return:

Frequently Asked Questions (FAQs)

Q: What is the exemption limit for senior citizens for filing income tax?

A: The exemption limit for senior citizens varies based on their age. For individuals aged 60 years or older but less than 80 years, the exemption limit is 3,000,000. For super senior citizens aged 80 years and above, the exemption limit is 5,00,000.

Q: Can senior citizens avail of deductions in addition to the exemption limit?

A: Yes, senior citizens can avail themselves of deductions in addition to the exemption limit. They can claim deductions under various sections such as 80C, 80D, 80TTB, and 24(b) to reduce their taxable income further.

Q: What is Section 80C, and how does it benefit senior citizens?

A: Section 80C allows senior citizens to claim deductions of up to 1.5 lakhs on investments made in specified instruments like EPF, PPF, NSC, etc. This helps reduce their taxable income and lower their tax liability.

Q: Are senior citizens eligible for higher deductions on health insurance premiums?

A: Yes, senior citizens can claim deductions on health insurance premiums paid for themselves and their dependent family members. The maximum deduction limit is 50,000, which can go up to 1 lakh for super senior citizens.

Q: Can senior citizens claim deductions on home loan interest?

A: Yes, senior citizens who have taken out a home loan can claim deductions on the interest component of the loan repayment under Section 24(b). The maximum deduction limit is Rs. 2 lakh.

Q: Is the exemption limit for senior citizens the same every year?

A: No, the exemption limit may vary from year to year as per the provisions announced in the annual budget.

Q: What documents are required for filing income tax returns as a senior citizen?

A: Senior citizens need to gather documents such as Form 16, bank statements, investment details, and proof of deductions to file their income tax returns.

Q: Can senior citizens avail of benefits under the Pradhan Mantri Vaya Vandana Yojana (PMVVY)?

A: Yes, senior citizens can avail themselves of benefits under the PMVVY, a pension scheme specifically designed for them that offers regular income and financial security.

Conclusion:

In conclusion, senior citizens enjoy an exemption limit f when it comes to filing ITR. The exemption limits are higher for senior citizens as compared to non-senior individuals and they can also avail of various deductions. Senior citizens need to stay informed about the latest tax rules and take advantage of the available benefits. Tax planning is a must whether you are a senior citizen or not. Everyone must know the benefits available to them in the form of exemptions or any other scheme. Contact our team of experts to know more about this.