-

Posted By Gautam Banthia

-

-

Comments 0

Table of Contents

ToggleLLP vs Partnership Firm: Introduction

In the world of business entities, limited liability partnerships (LLPs) and partnerships hold significant importance. Both of these structures provide unique advantages and disadvantages, which can significantly impact the success and operations of a business. In this article, we will explore the differences between LLPs and partnerships, shedding light on their distinct characteristics and legal aspects.

When starting a business, choosing the right legal structure is difficult. LLPs and partnerships are two popular options, each with its own set of attributes and implications. Understanding these differences is essential for entrepreneurs, professionals, and investors alike.

Definition of LLP

A limited liability partnership, commonly known as an LLP, is a business structure that combines elements of partnerships and corporations. It provides a flexible framework for professionals and service-based businesses. The LLP is a separate legal entity. The LLP itself will be liable for the full extent of its assets, and the liability of the partners will be limited.

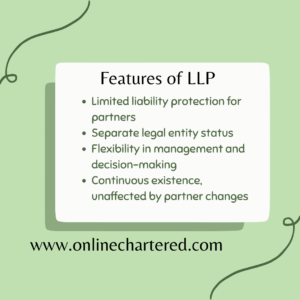

Features of LLP

Advantages of LLP

- Limited liability protection: LLP members have their personal assets protected from business debts and liabilities.

- Flexibility in management: LLPs have the flexibility to choose their management structure and decision-making processes.

- Professional credibility: For professionals like lawyers and accountants, an LLP structure enhances credibility and provides a recognized business form.

Disadvantages of LLP

- Compliance requirements: LLPs have certain legal and compliance obligations, such as filing annual returns and maintaining proper accounting records.

- Higher setup costs: Forming an LLP may involve higher initial costs compared to a simple partnership due to registration fees and legal documentation.

Definition of partnership Firm

A partnership is a traditional form of business structure where two or more individuals collaborate and share profits, losses, and responsibilities. A partnership is a contract wherein parties, also referred to as business partners, decide to work together to further their shared objectives. A partnership may have one or more individuals, corporations, nonprofits, educational institutions, governmental bodies, or other entities as partners. Organizations may collaborate to broaden their reach and improve the chances that each will succeed in reaching its goals. A partnership might issue and hold stock, or it might just be bound by a contract.

Features of Partnership

Advantages of Partnership

- Simplicity: Partnerships are relatively easy and inexpensive to set up, with minimal legal formalities.

- Shared workload and expertise: Partners can pool their resources, skills, and expertise, sharing the workload and benefiting from each other’s strengths.

- Tax flexibility: Partnerships offer flexibility in tax planning as profits and losses are distributed among partners based on their partnership agreement.

Disadvantages of Partnership

-

Unlimited personal liability: Partners are personally liable for the debts and obligations of the partnership, which can put their personal assets at risk.

-

Limited access to capital: Partnerships may face limitations in raising capital compared to other business structures as partners contribute from their own funds.

Differences between LLP and Partnership Firm

LLP vs Partnership Firm

|

|

Aspect | Limited Liability Partnership(LLP) | Partnership firm |

| 1 | Regulating act: | The limited liability partnership act,2008 | The Indian partnership act, of 1932 |

| 2 | Structure | LLP must have at least two designated partners | Comprises two or more partners |

| 3 | Taxation | Taxed as a separate legal entity | Partners taxed individually |

| 4 | Common seal | It may have its common seal as its official signature. | There is no such concept in partnership |

| 5 | Annual Filing | Annual filing of financial statements required | No requirement for annual filing |

| 6 | Continuity | Continuity beyond the death or departure of a member | Dissolution upon death or departure of a partner |

| 7 | Designated partners | At least two designated partners and at least one of them shall be resident in India. | There is no provision for such partners under the Partnership Act, of 1932. |

| 8 | Foreign partnership | Foreign nationals can become a partner in an LLP. | Foreign nationals cannot become a partner in a partnership firm. |

| 9 | Name | Must include “LLP” in the name | No specific naming requirement |

| 10 | Transferability | Ownership interest can be transferred | Ownership interest cannot be transferred |

| 11 | Separate legal entity | It is a legal entity separate from its members. | It is a group of persons with no separate legal entity. |

| 12 | Minor as partner | A minority cannot be admitted to the benefits of LLP. | Minor can be admitted to the benefits with the prior consent of the existing partners. |

| 13 | Body corporate | It is a body of corporate | It is not body corporate |

| 14 | Registration | Registration is mandatory | Registration is voluntary. |

Frequently Asked Questions (FAQs)

Q: Can an LLP have multiple business owners?

A: Yes, an LLP can have multiple partners who jointly own and manage the business.

Q. Is an LLP the right choice for a small business?

A: LLPs can be a suitable option for small businesses, especially those in the professional services sector, due to their limited liability protection and tax benefits.

Q. Do partnerships have to register with any government authority?

A: In many jurisdictions, partnerships are not required to register with a government authority, making them relatively easier to establish.

Q: Can an LLP be converted into a partnership or vice versa?

A: In some cases, LLPs can be converted into partnerships or vice versa, subject to the specific laws and regulations of the jurisdiction.

Q: Are LLPs and partnerships subject to annual compliance requirements?

A: LLPs and partnerships are typically required to fulfill annual compliance requirements, including filing necessary documents and financial statements.

Conclusion

In conclusion, understanding the differences between LLPs and partnerships is crucial for entrepreneurs and professionals looking to establish a business. LLPs offer limited liability protection and flexible management, while partnerships provide simplicity and shared decision-making. Assessing your business’s specific needs and goals will help you make the right choice.