-

Posted By Gautam Banthia

-

-

Comments 0

Table of Contents

ToggleIntroduction

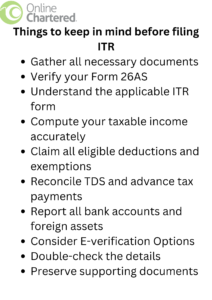

When filing your Income Tax Return (ITR), there are several important points to keep in mind. Here is an introduction to some key considerations:

Gather all necessary documents:

Collect all relevant documents such as Form 16 (provided by your employer), bank statements, investment proofs, rent receipts, and any other documents related to your income, deductions, and expenses.

Verify your Form 26AS:

Form 26AS is a consolidated tax statement that shows the taxes deducted on your behalf by employers, banks, or any other deductors. Verify that the details in Form 26AS match the information you have. This will help avoid any discrepancies in your ITR.

Understand the applicable ITR form:

There are different ITR forms available for different types of taxpayers and sources of income. Make sure you choose the correct ITR form that suits your income sources and category of taxpayer (individual, HUF, company, etc.).

Compute your taxable income accurately:

Calculate your total income by considering all sources, including salary, interest, rental income, capital gains, and any other applicable income. Deduct eligible deductions such as investments, medical expenses, and allowances to arrive at your taxable income.

Claim all eligible deductions and exemptions:

Take advantage of various deductions and exemptions available under the Income Tax Act. Some common deductions include those for investments in tax-saving instruments like Provident Fund (PF), Public Provident Fund (PPF), National Pension Scheme (NPS), and deductions for medical insurance premiums, education loan interest, etc.

Reconcile TDS and advance tax payments:

Ensure that the tax deducted at source (TDS) from your salary, interest income, or any other income matches the details in your Form 16/Form 16A. Also, verify if you have paid any advance tax during the financial year. The TDS and advance tax payments should be appropriately reflected in your ITR.

Report all bank accounts and foreign assets:

Disclose all your bank accounts, including those that are dormant or not operational. If you have foreign assets or foreign income, make sure to comply with the reporting requirements as per the tax laws of your country.

Before submitting your ITR, it’s crucial to double-check the accuracy of the information provided. Carefully review the form for any errors or omissions that could lead to discrepancies or unnecessary scrutiny from the tax authorities. Pay close attention to details such as PAN, bank account details, and amounts entered. Thoroughly reviewing your ITR will minimize the chances of errors and potential penalties.

Consider E-verification Options:

E-verification of the filed ITR offers convenience and saves time compared to the traditional method of physical verification. The Income Tax Department provides multiple options for e-verification, including net banking, Aadhaar OTP, and EVC (Electronic Verification Code). Opting for e-verification ensures faster processing and eliminates the need to send physical documents by post.

Double-check the details:

Carefully review all the details filled in your ITR forms, such as your name, PAN, address, income details, and bank account details. Any errors or discrepancies can lead to processing delays or tax notices. Before submitting your ITR, it’s crucial to double-check the accuracy of the information provided. Carefully review the form for any errors or omissions that could lead to discrepancies or unnecessary scrutiny from the tax authorities. Late filing may attract penalties and interest. Keep track of the deadlines announced by the tax authorities for each financial year.

Preserve supporting documents:

Retain all the supporting documents related to your income, deductions, and expenses. These documents may be required for future reference or in case of any tax scrutiny or audit. It is advisable to consult a tax professional or seek guidance from a qualified chartered accountant to ensure compliance with the tax laws and to optimize your tax planning and filing process.

Conclusion

Filing Income Tax Returns is a crucial task that requires careful attention to detail. By following the outlined steps and considering things to keep in mind before filing ITR in this article, you can ensure a smooth and accurate filing process. Remember to gather all relevant financial documents, choose the correct ITR form, stay updated with tax laws, and seek professional assistance when needed. Double-check the accuracy of the information, submit your ITR on time, and be prepared for potential audits or scrutiny. Preserve the acknowledgment receipt and stay compliant with tax obligations. By doing so, you can fulfill your tax responsibilities and contribute to a well-organized financial life. Therefore, it is always better to consult a Chartered Accountant expert in filing ITR. We at online chartered provide easy access to accurate and timely ITR filing with expert advice.

FAQs

Q: Do I need to file ITR if I have only salary income?

A: Yes, if your total income exceeds the basic exemption limit, you are required to file your ITR even if you have only salary income. It’s important to report all sources of income accurately.

Q: Can I file my ITR online?

A: Yes, the Income Tax Department provides online options for filing ITR. You can choose to file your ITR electronically through the department’s official website or other authorized platforms.

Q: What happens if I miss the deadline for filing ITR?

A: Missing the deadline for filing ITR can attract penalties and interest on any outstanding tax liability. It’s crucial to be aware of the due dates and file your ITR within the specified timeframe.

Q: What are the consequences of incorrect or inaccurate filing?

A: Incorrect or inaccurate filing can lead to scrutiny by the Income Tax Department, resulting in additional inquiries and potential penalties. It’s essential to double-check the information provided before submitting your ITR.

Q: How long should I keep the financial records related to ITR?

A: It’s advisable to preserve your financial records related to ITR for at least six years from the end of the relevant assessment year. These records may be required for reference in case of any future inquiries or audits.