MSME, DPT and LLP: ROC Compliances

ROC Compliances:

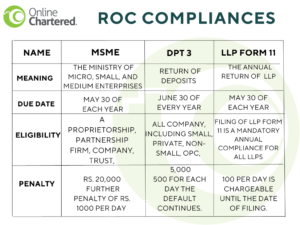

What is MSME?

MSME is an abbreviation for Micro, Small, and Medium Enterprises.

Composite Criteria for Fall under MSME as applicable from 1st July 2020

| Enterprises | Turnover | Investment in plant and machinery |

| Micro | Not more than Rs. 5 crores | Not more than Rs.1 crore |

| Small | Not more than Rs. 50 crores | Not more than Rs.10 crore |

| Medium | Not more than Rs. 250 crores | Not more than Rs.50 crore |

A proprietorship, partnership firm, company, trust, or society with an investment below Rs. 50 crore and an annual turnover below Rs. 250 crore is eligible for MSME registration.

Promote the growth and development of micro, small, and medium enterprises, including Khadi, village, and coir industries, to create new enterprises and more employment opportunities.

The due date for filing MSME Form 1?

Every company is required to file the MSME Form I as a half-yearly return by October 31st, effective for the period from April to September, and once again by April 30th for the period from October to March every year, relating to the outstanding payments to MSME.

Non-compliance with MSME Form-1 of the MCA?

As per Section 405(4), the company and every company that is in default shall be liable to a penalty of Rs. 20,000 and, in case of continuing failure, a further penalty of Rs. 1000 per day after the first day during which such failure continues, subject to a maximum of Rs.

What is DPT 3?

DPT 3 is a return of deposits that companies must file to furnish information about deposits and/or outstanding receipts of loans or money other than deposits.

The due date for filing DPT is:

The due date for filing the annual return is June 30 of every year. For example, for FY 2023–24, the due date for DPT-03 is June 30, 2023.

Who is eligible for DPT 3 in India?

DPT-3 must be filed by all the companies that have received money and the loan that is due. The DPT-3 form must be filed by all the companies, including small, private, non-small, OPC, etc.

Who is exempt from filing Form DPT-3?

Non-banking financial companies registered with the Reserve Bank of India and government companies are exempt from filing DPT-3. However, insurance companies will not be eligible for such an exemption as they are not registered with the RBI.

Documents required for filing DPT 3:

Auditors certificate, Copy of trust deed and deposit insurance contract, wherever applicable and mentioned in the form, Copy of the instrument creating the charge, List of depositors: list of deposits matured and checks issued but not yet cleared to be shown separately, Details of liquid assets, Optional attachment

Non-filing of the DPT-3 form:

A fine of up to 5,000 on the company and each officer in default, plus a fine of INR 500 for each day the default continues.

What is LLP Form 11?

LLP Form 11 is the annual return of a limited liability partnership (LLP). The return must be e-filed each year with the Ministry of Corporate Affairs to maintain compliance and avoid penalties.

Due date of LLP Form 11?

Form 11 is due on May 30 of each year. All LLPs registered under the Limited Liability Act, 2008, have to annually file two forms: Form 11 and Form 8. For example, for FY 2023–24, the due date for LLP Form 11 is May 30, 2023.

What are the documents required along with Form 11?

Details of LLP and/or company in which partners or designated partners (DP) are directors or partners (it is mandatory to attach these details in case any partner or DP is a partner in any LLP and/or director in any other company).

What are the consequences of filing Form 11 late?

The penalty of Rs. 100 per day is chargeable until the date of filing.

For more information contact our experts here:

You might like this:

5 Mandatory Compliances For Private Limited Company

Incorporation of the private limited company brings along some of the important and mandatory compliances

Online Chartered

November 18, 2021