Procedure to apply for higher pension

Who can apply:

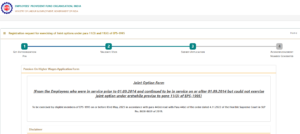

The EPFO circular does not include a higher pension option for employees who were members of the EPF before September 1, 2014, but are still working/retired after that date. According to the Supreme Court decision, those employees were entitled to a larger pension.

Documents required to apply for a higher pension:

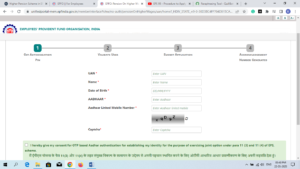

- Universal Account Number (UAN) for existing employees

- Pension Payment Order (PPO) in case of retired employees

- The mobile number linked with the Aadhaar number

- Member’s Aadhaar number, name, and date of birth should be available in the EPFO’s records

The last date to apply for a higher pension scheme is 26th June 2023.

Procedure to apply for higher pension

Step 1: Go on: epfindia.gov.in

Step 2: Click on services for employees

https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Click on pension on higher salary: the exercise of joint option under para 11(30) and para 11(4) on EPS 1995 on or before 26th June 2023.

Step:3 Know your UAN

Fill in all mandatory details

Submit all details carefully

Step: 4

Fill joint option and contribution details

Submit application

Step: 5

Save the acknowledgment number for future reference

Government notification:

(i) The members who opt for a joint option for contributing under the provision of paragraph 11 of the employee’s pension scheme,1995, and who are eligible, the employer contribution shall be 9.49% of the basic wages, dearness allowance and retaining allowance of each member by increasing 1.16% from the extant 8.33%

(ii) the increased contribution shall be applicable to basic wages, dearness allowance, and retaining allowance to the extent such basic wages and retaining allowance exceed 15000 p.m.

The calculation formula for higher pension:

(Pensionable Salary X Pensionable Service)/70

For example, a member who joined the scheme at the age of 25 and superannuated at the age of 60 could get a maximum of about Rs 7500 as a pension if service were 35 years (Pensionable Salary X Pensionable Service)/70 = (15000×35)/70 = 7500

FOR MORE INFORMATION CONSULT US