-

Posted By Gautam Banthia

-

-

Comments 0

Table of Contents

ToggleIntroduction:

The Budget 2023 has brought significant changes to the income tax structure in many countries. The new income tax regime aims to simplify the tax filing process while introducing revised tax rates and removing several deductions and exemptions. This article highlights the key changes introduced in the Budget 2023 and explores the pros and cons of the new regime. It provides strategies for optimizing taxes under the revised structure.

The new income tax regime is a comprehensive overhaul of the existing tax system, aiming to streamline the taxation process for individuals. It introduces revised tax slabs and eliminates several deductions and exemptions. Thus, it encourages taxpayers to reevaluate their financial strategies to maximize savings.

Key Changes in the Budget 2023:

1. Lower Tax Rates and Revised Slabs

Under the new regime, the tax rates were revised to provide relief to taxpayers. The slabs have been adjusted, resulting in lower tax liabilities for many individuals. Taxpayers now have a wide range of income with reduced tax rates. That allows them to keep a higher proportion of their income.

2. Removal of Deductions and Exemptions

One significant change in the new tax regime is the removal of various deductions and exemptions. Taxpayers can no longer help themselves with deductions for housing loan interest, medical insurance premiums, and education loan interest. But, the standard deduction and exemptions related to specified income categories remain intact.

3. Impact on Different Income Groups

The impact of the new income tax regime varies for different income groups. While individuals with lower incomes enjoy the revised slabs and lower tax rates. Those with higher incomes might experience a higher tax burden due to the removal of deductions and exemptions. Taxpayers need to assess their financial situations and plan.

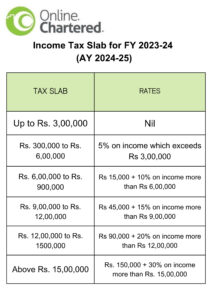

Income Tax Slab for FY 2023-24

(AY 2024-25):

Pros and Cons of the New Income Tax Regime:

Advantages

The new income tax regime offers several advantages. It simplifies the tax structure, reduces the number of tax slabs, and lower tax rates for many individuals. The revised system promotes transparency and eases the tax filing process. Additionally, the removal of deductions and exemptions helps cut the complexities associated with tax calculations.

Disadvantages

While the new regime has its benefits, it also has some disadvantages. The removal of deductions and exemptions might lead to a higher tax liability for individuals. The revised tax structure may also pose challenges for taxpayers in optimizing their tax planning. As they need to reevaluate their investments and expenses to maximize tax savings. Additionally, the impact of the new regime on different income groups can be uneven. It can be causing disparities in tax burdens.

Steps for Transitioning to the New Regime:

- Evaluate your current financial situation and assess the impact of the new regime on your tax liability.

- Review your investments, expenses, and deductions to identify necessary adjustments.

- Understand the revised tax slabs and rates to estimate your tax liability accurately.

- Consult with a tax professional to gain insights into the optimal tax planning strategies under the new regime.

- Update your financial records and ensure compliance with the new tax laws during the transition period.

Strategies to Optimize Tax Under the New Regime:

1. Revisiting Investments and Expenses

Taxpayers should review their investments and expenses to identify opportunities for tax optimization. This may involve reassessing investment portfolios, exploring tax-efficient instruments, and considering alternative strategies to reduce taxable income.

2. Tax Planning Techniques

Under the new regime, tax planning becomes crucial for minimizing tax liabilities. Taxpayers can explore techniques such as income deferral, asset restructuring, and exploring tax-saving investment options.

Comparison with the Old Tax Regime:

To fully understand the implications of the new income tax regime, it is essential to compare it with the previous tax structure. While the old regime provided more deductions and exemptions, the new regime simplified the tax system and introduced lower tax rates for specific income brackets. Taxpayers need to assess their circumstances and determine which regime offers greater benefits based on their financial goals and priorities.

Frequently Asked Questions (FAQs)

Q: Will the new income tax regime affect all taxpayers equally?

A: No, the impact of the new regime varies based on individual income levels and financial circumstances. Higher-income individuals may experience a higher tax burden due to the removal of deductions and exemptions.

Q: Can I switch between the old and new income tax regimes?

A: Yes, taxpayers have the option to choose between the old and new regimes each year, depending on which is more advantageous for them.

Q: What are the benefits of the new income tax regime?

A: The new regime simplifies the tax structure, introduces lower tax rates for specific income brackets, and promotes transparency in tax calculations.

Q: How can I optimize my tax liability under the new regime?

A: By revisiting your investments and expenses and employing tax planning techniques, you can optimize your tax liability under the new regime.

Q: Is seeking professional advice for tax planning under the new regime necessary?

A: While it’s not mandatory, seeking professional advice from tax consultants or financial planners can provide valuable insights and help maximize tax savings.

Conclusion

The new income tax regime 2023 brings significant changes to the tax structure, aiming to simplify the process and promote transparency. While it offers advantages such as lower tax rates and simplified calculations, taxpayers need to evaluate its impact on their specific financial situations. By revisiting investments and expenses and employing effective tax planning strategies, individuals can optimize their tax liabilities under the new regime. Understanding the key changes and seeking professional guidance can help taxpayers navigate the transition.