Composition scheme for service sector under GST:

Introduction and Meaning:

The composition scheme is a simplified tax scheme available for small taxpayers under the Goods and Services Tax (GST) in India. It allows eligible taxpayers to pay tax at a lower rate and comply with fewer compliance requirements.

Who is eligible?

For the service sector, the composition scheme is available to those service providers whose annual turnover does not exceed Rs. 50 lakhs.

- Turnover limit: A taxpayer whose aggregate turnover in the preceding financial year does not exceed Rs. 1.5 crore can opt for the Composition Scheme. For certain special category states, the turnover limit is Rs. 75 lakhs.

- Business type: This is available for businesses engaged in the supply of goods or services, except for a few types of businesses like ice cream and other edible ice, pan masala, tobacco, and manufactured tobacco substitutes.

- Registration: The taxpayer must be registered under the GST Act to opt for the Composition Scheme.

- Input Tax Credit: A taxpayer who opts for the Composition Scheme cannot claim an input tax credit (ITC) on purchases made for the business.

Advantages of the Composition scheme for the service sector :

- Reduced compliance burden: The Composition Scheme reduces the compliance burden for small service providers by allowing them to file quarterly returns instead of monthly returns, and by requiring them to maintain less detailed records.

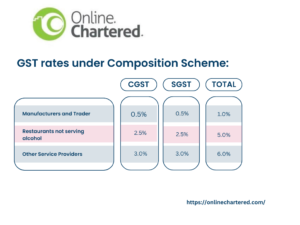

- Lower tax rate: Service providers who opt for the Composition Scheme are subject to a lower tax rate of 6% (3% CGST and 3% SGST) on their turnover, as opposed to the standard GST rate, which can be as high as 18%.

- Increased cash flow: Since service providers who opt for the Composition Scheme cannot claim an input tax credit (ITC), they are not required to maintain detailed records of their purchases.

Disadvantages Composition scheme for the service sector:

1. Limited eligibility: Only service providers with an annual turnover of up to Rs. 50 lakhs can opt for the Composition Scheme. This excludes many businesses from availing of its benefits.

2. No ITC: Service providers who opt for the Composition Scheme cannot claim an input tax credit (ITC) on their purchases. This means that they cannot offset the GST they pay on their purchases against the GST they collect on their sales, resulting in higher costs.

3. Limited invoicing options: Service providers who opt for the Composition Scheme must issue bills of supply instead of tax invoices. This limits their ability to show their customers the GST they are paying and can result in lower customer trust.

Who is not eligible?

However, certain service providers are not eligible for the composition scheme, including:

- Input service distributors.

- Service providers of non-taxable services.

- Interstate service providers.

- E-commerce operators are required to collect tax at the source.

- Service providers engaged in making supplies through electronic commerce platforms.

Under the composition scheme for the service sector, taxpayers are required to file quarterly returns instead of monthly returns. making compliance easier for small businesses. They also need to issue bills of supply instead of tax invoices.

It is important to note that once a taxpayer opts for the composition scheme, they cannot issue taxable invoices or collect tax from their customers. Additionally, if their turnover exceeds rs. 50 lakhs during the financial year, they must opt out of the composition scheme and comply with regular GST provisions.

GST rate under composition scheme:

Composition Scheme Under GST

Introduction The GST act specifies the detailed procedure for taxpayers regarding the frequency to file GST returns and also frequency to pay the taxes. There are two kinds of taxpayers under GST. GST act gives an option to tax payers whether they want to pay the taxes and file the returns under the normal or …

Composition Scheme Under GST Read More »

Online Chartered

June 2, 2022