About PAN Application

Online Chartered simplifies PAN card applications across Gujarat and India with our streamlined digital process. A Permanent Account Number (PAN) is your unique 10-digit financial identity, mandatory for tax compliance, business registration, and high-value transactions. Our expert team handles complete documentation, verification, and submission to the Income Tax Department, ensuring error-free applications. We support individuals, businesses, NRIs, and foreign nationals with comprehensive guidance from form filling to PAN delivery. With our proven track record and immediate response system, we make obtaining your PAN card hassle-free, allowing you to focus on your financial goals while we navigate regulatory requirements efficiently.

PAN Application Online | Apply For PAN Card in Gujarat

Meaning

What is PAN (Permanent Account Number)?

PAN, or Permanent Account Number, is a unique 10-digit alphanumeric identification number issued by the Income Tax Department of India to individuals, businesses, and other entities. It’s like your financial fingerprint, ensuring no two taxpayers have the same number.

Apply PAN

How to Apply for a PAN Card

Applying for a PAN card is simple and can be done online or offline.

Online Process

1. Visit the official NSDL PAN portal.

2. Fill out the application form with accurate details.

3. Upload the necessary documents and pay the processing fee.

4. Once your details are verified, your PAN will be issued.

Offline Process

1. Collect the application form from an authorized PAN center.

2. Fill out the form and attach the required documents.

3. Submit the form along with the processing fee.

4. After verification, your PAN will be issued.

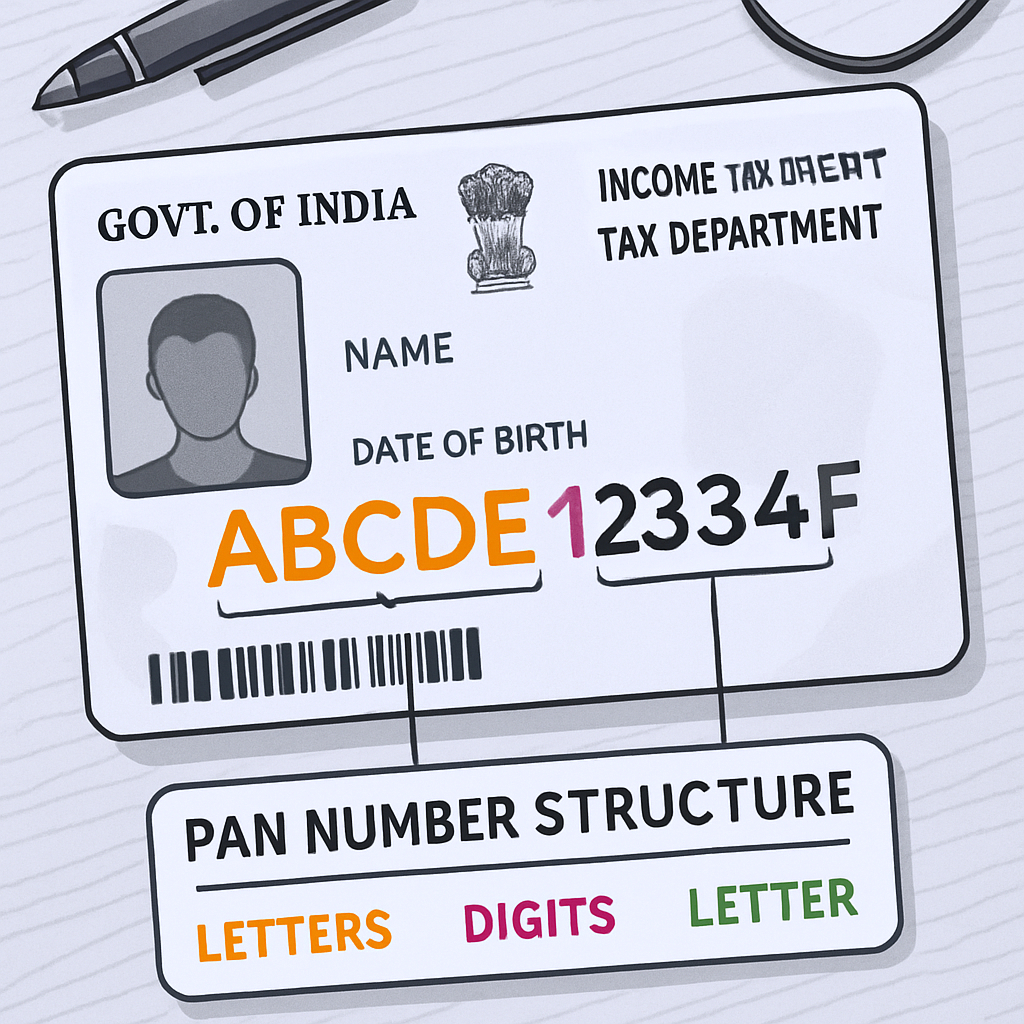

Understanding the Structure of a PAN Number

A PAN is more than just a random number—it reveals key information about the holder:

1. First 3 Characters: Random alphabets (e.g., ABC).

2. 4th Character: Indicates the category of the taxpayer:

P: Individual

C: Company

H: Hindu Undivided Family (HUF)

F: Firm

A: Association of Persons

T: Trust

G: Government

3. 5th Character: The first letter of the individual’s surname or entity name.

4. Next 4 Characters: Random numbers.

5. Last Character: A random alphabet.

Why is PAN Important?

As Proof of Identity and Address

PAN serves as a valid proof of identity and address for individuals and businesses.

For Filing Taxes

PAN is mandatory for filing income tax returns, ensuring tax compliance.

For Financial Transactions

PAN must be quoted for specific transactions, such as:

1. Buying/selling property worth ₹5 lakh or more

2. Buying/selling vehicles (except two-wheelers)

3. Paying bills exceeding ₹25,000 at hotels or for international travel

4. Depositing over ₹50,000 in banks

5. Investing in shares, mutual funds, bonds, or insurance policies worth ₹50,000 or more

6. Purchasing jewelry worth ₹5 lakh or more

7. Transferring money abroad or between NRE and NRO accounts

For Business and Banking Needs

PAN is required to register a business or open a bank account.

Who Needs a PAN? Anyone earning taxable income, running a business, or making large financial transactions needs a PAN. This includes:

-

Individuals (salaried, self-employed, freelancers)

-

Businesses (companies, partnerships, LLPs, trusts)

-

NRIs and Foreign Nationals conducting business in India

![tourist with backpack and climbing to top of mountain and holding the flag [Online chartered]](https://onlinechartered.com/wp-content/uploads/2025/01/tourist-with-backpack-and-climbing-to-top-of-mountain-and-holding-the-flag-1024x747.png)

Documents

Documents Required for PAN Application

Depending on the type of applicant, here’s what you’ll need:

For Individuals:

Aadhaar Card

Passport

Voter ID

Driving License

For Hindu Undivided Family (HUF):

Affidavit issued by the head of HUF

Proof of Identity (POI) and Proof of Address (POA)

For Companies (Registered in India):

Certificate of Registration issued by the Registrar of Companies

For Trusts:

Trust Deed or Registration Certificate from a Charity Commissioner

For Societies:

Registration Certificate issued by the Registrar of Societies

For Foreign Nationals:

Passport

PIO/OCI Card issued by the Indian Government

Bank Statement from the Residential Country

NRE Bank Statement in India

Key Features of a PAN Card

- Photo Identity: Acts as a photo ID for individuals.

- Signature Proof: Validates the holder’s signature for financial transactions.

- No Expiry: PAN is valid for a lifetime and doesn’t need renewal.

Benefits

Benefits of Having a PAN Card

PAN makes easier to file taxes and claim refunds.

Essential for opening bank accounts, applying for loans, and making significant purchases.

PAN ensures your investments in mutual funds, bonds, and shares are compliant with government regulations.

PAN is Widely accepted as a valid ID across India.

Quick Tips for PAN Application

- Ensure all your documents are up-to-date and match your application details.

- Double-check your details (name, date of birth) before submitting the form.

- Always apply through authorized platforms to avoid fraud.

FAQ

Get all your Queries Solved

A unique 10-digit alphanumeric ID issued by the Income Tax Department for financial and tax-related purposes.

It’s required for filing taxes, business registration, financial transactions, and as proof of identity.

Individuals, businesses, NRIs, and foreign nationals earning or making financial transactions in India.

- Individuals: Aadhaar, Passport, Voter ID

- Businesses: Registration Certificate

- Foreigners: Passport or NRE Bank Statement

- Online: Via NSDL website

- Offline: Through authorized PAN centers

PAN cards are issued within 15-20 days (e-PAN: 2-3 days).

No, it’s illegal to have more than one PAN.

Apply for a duplicate PAN online or offline.

Yes, for transactions like property purchases, investments, and foreign travel.

Yes, PAN is valid for life and does not require renewal.